Dh117.5 million average budget for a Dubai home: World’s richest bet big on luxury real estate

Dubai continues to be the most sought-after address for luxury real estate, with high-net-worth individuals (HNWIs) allocating increasingly higher budgets to purchase homes in the city. According to the 2025 edition of the Destination Dubai report by global property consultancy Knight Frank, a global HNWI now budgets an average of $32 million (Dh117.5 million) for a home in the emirate. More than half (54 per cent) of ultra-wealthy individuals — those with personal wealth exceeding $50 million — are willing to spend over $80 million.

This surge in demand reflects a broader trend that has seen Dubai become the busiest market in the world for $10 million+ home sales.

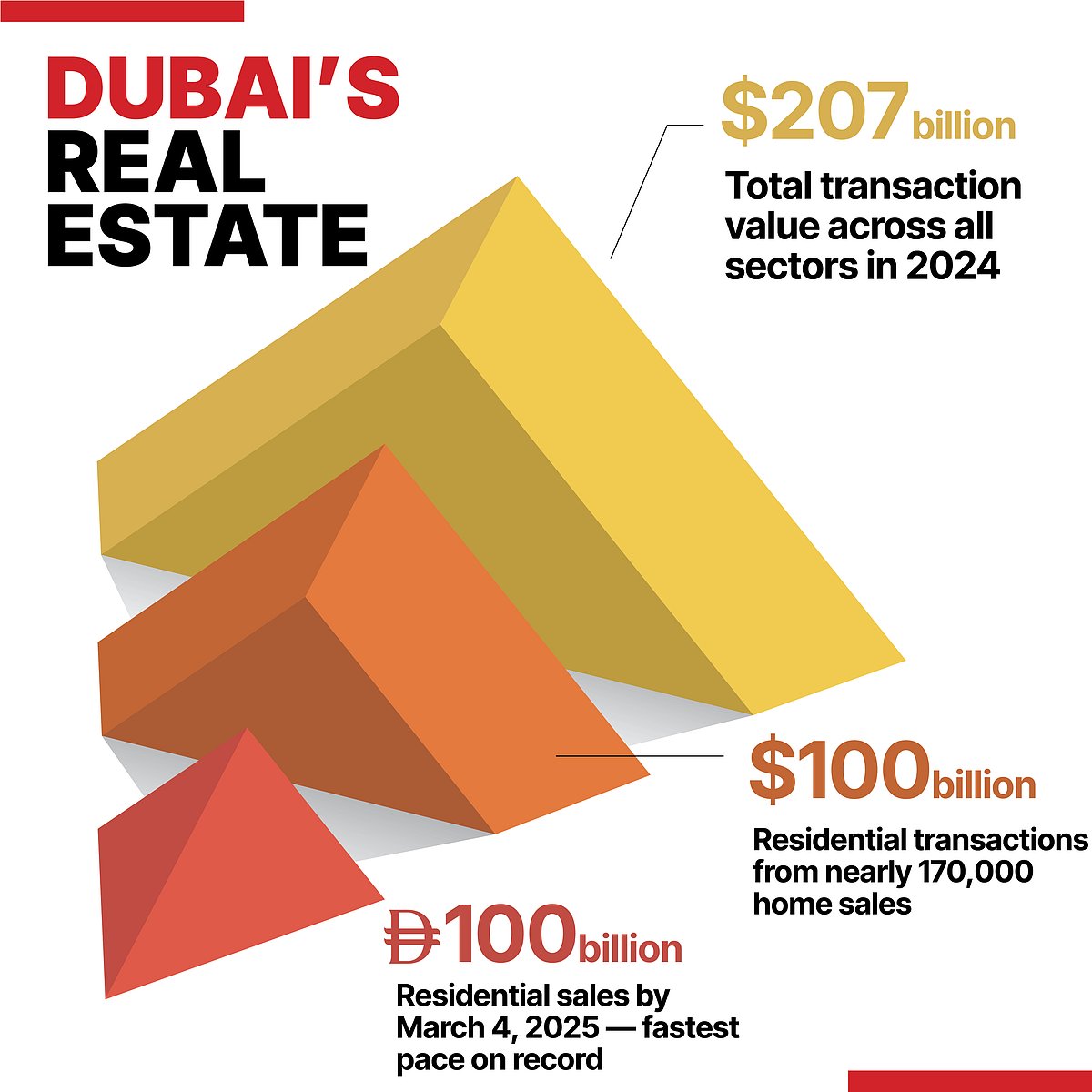

KT Graphic: Raja Choudhury

Not just villas

The property consultancy told Khaleej Times that Dubai currently has 150 homes priced above Dh100 million on the market. “And it’s not just villas that the global super rich are looking for either. 80 per cent of those with a net worth of $15-20 million are looking for an apartment … We need to ensure we get the balance right between ultra luxury villas and apartments — and key of course to the attractiveness and success of these developments is their exclusivity.”

The strongest appetite for a real estate purchase in the UAE comes from those with the greatest wealth, said Faisal Durrani, Partner and Head of Research for Mena at Knight Frank.

One of the many key defining features of the current property market cycle is the shift in the profile of buyers, with genuine end-users becoming more active than speculative purchasers.

“They are largely genuine end-users, purchasing homes for personal use. This is a sharp reversal in the ‘buy-to-flip’ investor profile that dominated the city’s two previous property cycles. Indeed, our data has revealed that 55 per cent of global HNWIs are keen to purchase real estate in Dubai for personal reasons, be it a holiday home, a second home, or indeed a main residence.”

According to Durrani, 83 per cent of global HNWIs are interested in purchasing land in Dubai to build their own home. “This appetite is high almost irrespective of nationality. Dubai has matured quickly throughout this property cycle and this is clearly evidenced by the desire of potential global HNWI home buyers to settle in the city.”

$10.3-billion future

Knight Frank estimates that the ultra-rich are poised to inject $10.3 billion into Dubai’s residential market. This projection is based on a survey of 387 HNWIs from India, Saudi Arabia, the UK, and East Asia (China, Hong Kong, and Singapore), each with an average net worth of $22 million.

UAE’s residential market is especially attractive to regional and global investors. Among Saudi HNWIs, 79 per cent target the UAE for residential purchases, followed by East Asians (68 per cent) and UK buyers (67 per cent). Branded residences are the second-most preferred segment, attracting 49 per cent of survey respondents.

Overall, 71 per cent of global HNWIs identified Dubai as their preferred emirate for real estate investment. That preference was highest among Saudis (80 per cent), followed by British (74 per cent), Indians (69 per cent), and East Asians (61 per cent).

“The depth of demand from these nationalities is also reflective of our own market experience,” said Will McKintosh, Regional Partner and Head of Residential, Mena at Knight Frank. “During 2024, Saudi, Indian and British nationals accounted for just over 50 per cent of homes sold by Knight Frank in Dubai.”

KT Graphic: Raja Choudhury

Source: Khaleej Times